How to Choose a Perfect Payment Method for Online Casino Gaming

Having used free-play option to spin reels and chase winning combos in one or more of the popular card games, you come to a point when playing with fun credits ceases to be as exciting. Each major win you scored now appears to have been a missed opportunity to generate profits. A moment later, you decide to exploit your luck and skills towards a more tangible goal and make a real money investment.

There are two things to think about: how much cash you’re willing to risk and which payment method to use for transferring this amount to your casino account. The first decision is not all that difficult; as connoisseurs say, gamble only as much as you’re willing to lose. The second, however, is not as easy. Online casinos nowadays support a whole range of payment options, each with pros and cons one should be aware of before making a decision.

Credit/Debit Cards

The majority of online casino operators will offer you to pay via at least two credit cards – Visa and MasterCard. Players like them because they are convenient to use and highly secure. Embedded microchip makes every transaction unique and thus protects us against fraud. MasterCard ID Theft Protection is used to discover and deal with identity theft, and thanks to the Zero Liability feature, the user is not held responsible for any unauthorised transactions.

Visa implements similar tools: a sophisticated fraud detection system which can identify potentially fraudulent activity by using predictive analytics, Verified by Visa that makes sure payments are executed by the account owner and not someone else, etc. Some gaming sites allow MasterCard deposits and ask that you use another option for making a withdrawal, but Visa is usually available for both. What’s more, operators rarely apply any transaction fees. No matter which card one uses, cash can be easily withdrawn via one of many ATMs clients will find in their vicinity.

Pros

- Convenience – we already own them, so there’s no need to open additional accounts and learn how to use the payment method

- Safety – service providers apply high-security standards

- Availability – Visa and MasterCard are widely accepted in the online gaming world

- Limits – operators usually apply higher transaction limits to credit card deposits and withdrawals than to most other options

Cons

- Fees – card issuers fees

- Lack of anonymity – players have to share credit card information and billing address

How to Use Credit Cards for Making Casino Deposits

- Access the cashier and select Visa or MasterCard from the list of deposit options

- Fill out the requested information – your name, card number, expiration date and CVC security code

- Enter the amount you want to deposit and confirm the payment

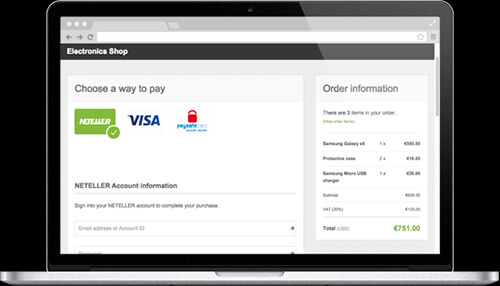

E-Wallets

E-Wallets, primarily Skrill and Neteller, are another highly popular and widely supported tool for making online casino deposits. PayPal is slowly but surely enlarging its presence on the online gaming scene and you’ll more or less frequently also find ecoPayz, iDeal, WebMoney, Instadebit, Click2Pay, ClickandBuy, Ewire, Moneta.ru and Yandex Money. MuchBetter is the newest and the most revolutionary payment service provider that has already managed to partner up with more than a few popular and highly reputable gaming sites.

The biggest advantage of eWallets is that, next to cryptocurrencies, there’s no faster way to claim your winnings once the casino has processed your withdrawal request. One has to start off by signing up for the services, which doesn’t take long, though there will be a need to go through an additional ID verification process to be able to use all functionalities and enjoy higher limits. That can be a drag, but remember – you’ll only have to do it once. Verification is done by uploading a scan of a document such as a driving license, passport or a national ID, along with a selfie with the chosen document.

Once you have signed up for an e-Wallet, you’ll need to fill it just as you would a physical one. Depending on the service provider, clients can fund e-Wallet accounts via a range of credit and debit cards, other eWallets, PaySafeCard, Bitcoin and Bank Transfer. PayPal charges the bank account or the card you have previously linked, which is why you don’t need to have PayPal balance. Receipts are sent for each payment so that you can keep track of the spending.

The majority of e-Wallet providers offer a prepaid MasterCard that can be used to collect cash via ATMs, and a mobile app for iOS and Android devices which enables users to access their accounts and make payments 24/7. They all use certified encryption technology and anti-money laundering protocols which protect clients from fraud and identity theft. Accounts and transactions are monitored at all times so that any suspicious behaviour can be immediately spotted. Both Skrill and Neteller use two-step authentication process which adds a layer of security and makes it even harder for fraudsters to get hold of sensitive information.

While registering for an e-Wallet is always free, there are fees to be paid for funding it and withdrawing from it. One should also be aware of the costs incurred by currency conversion.

| eWallet | Funding | Withdrawing | Currency conversion |

| Skrill | 1% | €5.5 for transferring to bank account

7.5% for withdrawing to Visa |

3.99% |

| Neteller | 2.5% | €10 for transferring to bank account

1.75% for transferring to card |

3.99% |

| PayPal | $0-$4.95 | 0-2.5% for transferring to bank account

€2 for withdrawing to card |

2.5-4.5% |

| MuchBetter | 0% via bank transfer

2% via Bitcoin 2.65-5% via credit cards |

2% for SEPA bank transfer

€60 for non-SEPA bank transfer 0.99% for cashing out via ATM |

1% |

How to Use e-Wallets for Making Casino Deposits

- Select Skrill/Neteller from the list of available deposit options

- Enter the email address you’ve used for opening e-Wallet account

- Choose the amount you wish to pay into your casino account

- Log into your e-Wallet account to confirm the transaction

Pros

- Convenience – deposits and withdrawals are made with nothing else other than an email address and a password

- Speed – e-Wallet deposits are instant and withdrawals take no more than 1-2 days

- Privacy – No sensitive information needs to be shared with the casino operator

- Security – accounts and transactions are protected by encryption technology, anti-money laundering protocols, and 2-step authentication

Cons

- Registration – an account needs to be opened and funded before an e-Wallet can be used for making payments

- Bonus restrictions – more and more gaming sites make their welcome offers unavailable to players depositing via Skrill or Neteller

Thanks to its many benefits, MuchBetter deserves a section of its own. A mobile phone is all one needs for executing deposits and withdrawals, fees are lower than with any other e-Wallet, and the service is available all over the world, though currently mostly used by players from Canada, Germany, Netherlands and the UK. It’s accessible only via mobile devices so you’ll have to start by downloading the MuchBetter App and then go through a sign-up process. Name, phone number, email and home address are information required for the initial registration, and you’ll also need to choose a 4-digit passcode.

How to Use MuchBetter for Making Casino Deposits

- Access the cashier and select MuchBetter

- Enter your mobile number

- Approve the request received via your MuchBetter App

Pros

- Convenience – users only need a mobile phone and a passcode

- Speed – transactions are processed instantly

- Security – a combination of device pairing and dynamic security codes

- Fees – lowest funding/withdrawal/currency conversion fees

Cons

- Availability – distribution is still low compared to Skrill and Neteller

Prepaid Cards

Prepaid cards are a great funding option for players who don’t have a bank account as well as those that wish to minimise the risk of overspending. Some prepaid cards, such as frequently featured PaySafeCard, Neosurf and AstroPay, come loaded with a fixed amount; once it’s used up, you have to go and purchase another card. Others (EntroPay, Todito Cash, Postepay) can be loaded with an amount of money of your choice and later on reloaded.

Having signed up for PaySafeCard service, you’ll be granted a standard account which can be funded by visiting a physical outlet and buying PaySafeCard worth between £10 and £100, or by purchasing PINs at an authorised online shop. Either way, you’ll receive a 16-digit PIN which is needed to execute online purchases. PaySafeCard account allows you to pay via the internet using only your username and password, while prepaid PaySafeCard MasterCard enables you to pay both online and offline. The service is virtually free except for a tiny monthly maintenance fee and potential conversion fees applied when paying in foreign currency. Online casinos won’t usually charge any fees.

How to Use Prepaid Cards for Making Casino Deposits

- Find a casino which supports PaySafeCard deposits and access its banking page

- Select PaySafeCard from the list of payment option

- Enter the amount and a 16-digit PaySafeCard code

Pros

- Convenience: no need for a bank account or a credit card

- Anonymity: there is no record of money being spent on gambling

- Security: no links to your bank account/credit card

- Spending control: once the money is spent, a new card has to be bought or the existing one reloaded

Cons

- Deposits only: prepaid cards can’t be used to make withdrawals

- Limits: online casinos attach low limits to prepaid card deposits

Instant Bank Transfer

Often enough, casino accounts can be funded via one of several Instant Bank Transfer options such as Trustly, iDebit, Sofort, Euteller, Giropay and Nordea. Each of these payment providers acts as an intermediary between the online casino and your bank, allowing you to pay through your online banking system and at the same time benefit from bank-level security.

Trustly is an online payment option available to players in 29 European countries, among which Germany, Austria, UK, Italy, Spain, Poland and Nordic countries. In order to use the service, you’ll need to have an account in one of the participating banks. Trustly not only supports real-time deposits but also features Payout Express which enables instant withdrawals. You don’t have to register to use the service and Trustly will never store any of your bank account related information. The company uses the highest encryption standard in addition to your banks’ security system. Though Trustly won’t charge you anything, your bank and some online casinos might.

How to Use Trustly for Making Casino Deposits

- Go to the casino’s cashier and find Trustly on the list of deposit options

- Choose your country and bank

- You’ll be redirected to your online banking to complete the transaction

The prerequisite for using iDebit is that you have a bank account (along with access to online banking) at Bank of Montreal, Canadian Imperial Bank of Commerce, Desjardins, National Bank, Royal Bank of Canada, Scotiabank, Simplii Financial or TD Canada Trust. You can either open an iDebit account before trying to execute any payments or quickly sign up while making your first iDebit transaction.

The payment service provider doesn’t store your banking details and uses 128-bit technology to keep your personal information safe while it travels via the internet. Signing up for the service is free and so are the payments from existing iDebit balance and transfer of funds from a third party to your iDebit account; however, you will be charged $1.5 for online banking payments and $2 for transferring money from iDebit balance to your bank account.

How to Use iDebit for Making Casino Deposits

- Select iDebit as a deposit method on the casino’s banking page

- Enter the deposit amount

- Log into iDebit and select your bank

- Use your internet banking credentials to approve the transaction

Interac is Canada’s leading online payment service used for moving funds from one bank account to another. It’s currently supported by 250+ financial institutions, among which the Royal Bank of Canada, Bank of Montreal, Canadian Imperial Bank of Commerce, Scotiabank and TD Canada Trust.

Clients can use Interac Online to pay via their online banking and are able to withdraw money at ATMs via Interac Cash. Their funds and personal information are protected by authentication and transaction encryption, user IDs and passwords, a secure login process, chip technology used with Interac Debit card, and other security measures. The service provider won’t charge you any fees and, usually, neither will the casino, but your bank may make you pay a transaction fee.

How to Use Interac for Making Casino Deposits

- Choose Interac as a deposit method

- Having been redirected to Interact Online gateway page, select your bank

- Login to your online banking, enter the amount and confirm the transaction

Nordea services are available to anyone with a bank account at one of the financial institutions that are part of the Nordea network (Scandinavia, Russia and the Baltic region). The service is considered to be highly secure thanks to so-called access codes. NemID consists of a user ID, password and a code card/code app, the latter sending transaction-specific login, confirmation and identification codes which need to be used for internet banking and online purchases. Nordea customers are also able to obtain a Visa or MasterCard.

How to Use Nordea for Making Casino Deposits

- Choose Nordea from the list of deposit options

- Once redirected to Nordea login page, use access codes to sign in

- Follow instructions and finally enter the confirmation code

Giropay is an Instant Bank Transfer tool available to residents of Germany and Austria. The list of supported banks includes Sparkasse, Volksbanken Reiffeisenbanken and Postbank as well as a number of PSD and private banks, such as comdirect, Deutsche Kreditbank and MLP Bank.

There’s no hassle of going through additional registration procedures and remembering new PINs and passwords; all one needs in order to pay via Giropay is online banking access information, namely PIN and TAN. Giropay will not charge you for using its services but you have to reckon with standard bank fees which usually vary between 0.9% and 1.2% plus a fixed fee of €0.08 per transaction.

How to Use Giropay for Making Casino Deposits

- Choose Giropay as your funding method

- Enter the amount you wish to deposit and select your bank

- Once redirected to your online banking page, enter your account number and PIN

- The bank sends TAN which is used to confirm the payment

Pros

- Convenience – users only need to have an online banking account with a participating bank

- Security – thanks to the intermediary, no sensitive financial details are shared with the recipient

Cons

- Availability – choice of Instant Bank Transfer options varies from one online casino to another

Bank Transfer/Wire Transfer

Bank Transfer is like a grandfather to all other payment options mentioned above. It facilitates movement of funds from one bank to another, where the one sending the money orders their bank to transfer a specified amount and provides the recipient’s bank details. It’s easy since no extra accounts need to be opened, there are no PINs and passwords to think of and memorise, and last but not least, it’s extremely secure.

The main drawback is that Bank Transfer is slow; your financial institution will have to confirm the payment before cash shows up in your casino account, and it may take 5-6 (or more) business days before winnings end up in your bank account. There will be bank fees to pay, and often enough, the casino operator will also charge a hefty amount.

How to Use Bank Transfer for Making Casino Deposits

- Access the cashier page and select Bank Transfer

- Choose your bank from the list, login to your online banking and request transfer, or

- Copy provided details of the operator’s bank account, login to online banking and complete the payment

Mobile Payment Tools

Online casino fans are increasingly doing their gambling on the go via smartphones and tablets, so it makes sense to offer them convenient options to execute payments using the same tool. Mobile payment methods like Zimpler, Boku, Siru Mobile and PayForIt are often included into deposit options and deposited amounts either added to the user’s monthly phone bill or invoiced via an SMS.

- Zimpler, previously known as PugglePay, automatically creates an account for you the first time it’s chosen as an online payment option. Users can pay Zimpler bills with Visa and MasterCard, Swish or directly through their bank. Credit card payments are free but settling the bill via your bank incurs a cost which depends on the value of the deposit made. Online casinos rarely attach any fees to Zimpler deposits. The service provider implements industry-standard SSL encryption and requires that each transaction is approved by a code which they’ll send you in an SMS.

- Siru Mobile requires no registration, and same as with Zimpler, you only need to select it as a payment option, accept terms and confirm the transaction. When doing it for the first time, the provider will send you an SMS code which you’ll use to verify your phone number. The deposited amount will be added to your monthly bill.

- Boku is yet another option which doesn’t require that you register for the service. Having chosen it as a deposit method, you’ll receive a text from the service provider asking you to confirm the payment. Boku will then charge the phone network you’re using and they will collect what they’re owed by adding the amount to your phone bill.

How to Use Mobile Payment Tools for Making Casino Deposits

- Select Zimpler or Siru among deposit options and enter the amount you wish to pay

- Enter your phone number to receive a verification code

- Use the code received to confirm the transaction

Pros

- Convenience: no bank account or credit card required

- Simplicity: fast and simple mobile phone payments with no PINs or passwords to memorize

- Safety: your phone number is the only piece of information that needs to be shared with the operator

Cons

- Deposits only: mobile payment options can’t be used for withdrawals

- Limits: both service providers and online casinos set low limits

- Availability: service available in a limited number of countries

Digital Currencies

There are more and more online casinos offering players to pay with Bitcoin and other cryptocurrencies. Quite a few try to motivate your choice by attaching favourable limits and/or offering bigger and better bonuses for Bitcoin deposits. Operators like digital currencies because there are no payment-processing costs to cover, which at the same time benefits players.

Cryptocurrencies feature a unique mechanism which creates benefits other payment providers can’t match. Cryptographic protocols based on advanced mathematics are as good as unbreakable, with complex code systems used for controlling the creation of new units and verifying transfers. Even though all transactions are recorded within a blockchain (which can also be used to validate currency ownership), the identity of the user is fully protected. Bitcoin withdrawals are pretty much instant, faster even than eWallet cash-outs. Still, terms like blockchain, public address and private key, and the general lack of understanding as to how digital currencies function, make non-users reluctant to give them a try.

How to Use Digital Currencies for Making Casino Deposits

Before you can start paying with Bitcoin and other cryptocurrencies, you’ll need to set up an online or offline wallet which comes with a public address. The latter is essentially the location to which funds can be added by anyone but only the holder of the key (you) can collect and spend them. Then you’ll need to purchase Bitcoin at one of many Bitcoin Exchanges.

From there on, the process is relatively simple:

- Choose Bitcoin as a deposit method

- Copy the address given by the gaming site

- Go to your Bitcoin wallet, paste it and approve the payment

Pros

- Speed – instant deposits and withdrawals

- Anonymity – no personal information is shared

- Security – without the key, no one can touch your Bitcoin

- Fees – no fees to be paid

- Additional benefits – exclusive Bitcoin bonuses

Cons

- Complexity –a new user may be confused

- Availability – cryptocurrencies are not as widely accepted as credit/debit cards and eWallets

What is the Perfect Payment Method for Online Gaming?

This is not a case of “one size fits all”. Each player should make their choice based on what they value the most – being able to use the same method for deposits and withdrawals, collect their cash as quickly as possible, minimise fees, enjoy generous payment limits, etc. Below is a short overview which can help you choose.

| Deposits/ Withdrawals | Cashout speed | Fees | Limits | Simplicity | Privacy | |

| Credit/debit cards | Y/Y | 2-3 days | Medium | Wide | Medium | Low |

| eWallets | Y/Y | 1-2 days | Low | Wide | Simple | Medium |

| Prepaid cards | Y/N | – | Low | Low max | Simple | High |

| Instant Bank Transfer | Y/Y | 3-4 days | Medium | Wide | Simple | Medium |

| Bank Transfer | Y/Y | 5-6 days | High | High min | Medium | Low |

| Mobile Payment | Y/N | – | Low | Low max | Simple | High |

| Digital Currencies | Y/Y | Instant | Low | Wide | Complex | High |

Relevant news

Best Online Casino Payment Options for German Players

Although online gambling is banned outside Schleswig-Holstein, a number of online casino operators continue to…

Best Online Casino Payment Options for Canadian Players

In the past few years, the Canadian gaming scene has undergone significant changes, gradually evolving…

Best NetEnt Casinos That Accept MuchBetter

After a brief crisis that the company suffered last year, NetEnt has managed to spring…

Best Play’n GO Casinos That Accept MuchBetter

The phrase “survival of the fittest” seems to be redefining its terms in the online…

How to Beat Online Casinos

Thousands of players like yourself are continuously scouring available resources in the hope they’ll learn…

Reverse Withdrawals, Withdrawal Lock & Manual Flushing Explained

Online casino games are fun to play, even when we do it using only fun…